Posted by jeremyliew in advertising, facebook.

A couple of weeks ago Webtrends analyzed 11,529 Facebook ad campaigns representing 4.5bn impressions to see what conclusions they could draw. It’s worth reading their short white paper on Facebook Advertising Performance Benchmarks and Analysis. Some highlights include:

- Click through rates steadily increase with age up to 65

- State by state CTRs are relatively flat with the exception of North Dakota and Wyoming being substantially higher than the other states

- Fun/entertainment focused campaigns work better than other types of topics

- People who didn’t attend college click more than people who did

- People who attended college use their friends as a filter to determine who to click on more than people who didn’t attend college

- FB ads need new creative after three to five days

I’d urge you to read the whole thing. It’s only seven pages long.

Posted by jeremyliew in advertising, local.

Local has been a category that has long attracted a lot of attention from internet startups. Not surprising given that it is a $130Bn market. Now that Groupon and Living Social (a Lightspeed portfolio company) are growing s0 fast, it is attracting even more attention from startups.

Most of these startups focus on innovating on their product, and aim to have a “sales light” approach.

Usually they start with a self service business model, expecting local businesses to go to the web to sign up for service on their own. They mostly point to Google as the evidence that self service can scale.

I’ve long been skeptical that self service works for selling products to local businesses. From my time at CitySearch in ’96 to today, I haven’t seen this work. In fact, I’d argue that ReachLocal exists as a public company solely because Google can’t get local merchants to self serve. Today, perhaps lost in the holiday shuffle, the WSJ notes that even Google has turned to a call center sales force to reach local merchants.

The Internet-search giant this year has hired several hundred sales representatives to call U.S. businesses such as spas, restaurants and hotels to promote new advertising initiatives, people familiar with the matter said. The effort includes an office in Tempe, Ariz., with around 100 sales representatives, one of these people said.

The other business model that startups attacking local hope to rely on is channel partnerships. Many startups have struck deals with local yellow pages, or newspaper groups, to sell their product too. They have typically been disappointed when sales numbers come in far short of projections. It is hard to get someone elses salesforce to know and care about your product as much as you do, especially when they are used to selling traditional media and not online media.

The winners in this category (Yelp, Groupon, Living Social, Yodle, ReachLocal, CitySearch etc) have all relied on a direct sales force, whether on the phone, or feet on the street, to drive their revenue growth.

If you want to make a business in local online media, you have to control your own destiny and build your own salesforce.

Posted by Bipul Sinha in advertising, Consumer internet, social media, social networks, startups.

Tags: commerce, internet, media, mobile, social, TV

Some observations from Bipul Sinha about the internet and media industry in 2011.

1. Year of Social Utilities

With over half a billion users and open graph integration, Facebook is the Internet with social graph at its core. This is as much of a game-changer (due to a new distribution model based on the social graph) as going from offline to the Internet was in the 90s. A number of startup companies, I call them social utilities, are leveraging the social graph to potentially disrupt traditional online businesses such as dating, e-commerce, travel and recruitment. Yardsellr, Branchout, and Mertado are examples of such companies and we will witness a few scale companies emerging out of this space in 2011.

2. Display Advertising Enters a Golden Era

Innovations in media transaction platforms along with a better understanding of target audience have brought an amazing level of scale and efficiency in display advertising market. The use of data and technology will disrupt the premium, guaranteed media buying segment in the coming year resulting in an open, transparent marketplace for audience-based transactions. This marketplace will help bring price equilibrium to media supply and demand thereby further increasing the marketing budget spent on this medium. Startups to watch in this space are Legolas Media, Krux Digital, and BrightTag, among others.

3. Social Media based Discovery Traffic Breaks Out

In the traditional marketing parlance, Google directed web traffic represents bottom-of-the-funnel users who are ready to take an action now. The aggregation of such high-intent traffic is what makes Google a formidable force on the Internet. However, the emergence of social media in the past few years has created a new web where people are the nodes, connected through the social graph. The traditional advertising formats such as display lack both context and intent to be effective in the social media environments. New advertising platforms are emerging to enable advertisers to leverage engaged followings and connections on social media for brand and discovery advertising. The resulting web traffic represents top-of-the-funnel users who are interested in learning more about the products/services, but not ready to commit just yet. This discovery/intent web traffic will grow fast in the coming year to become a significant source of users/customers.

4. TV Goes Social via Mobile Devices

Since the advent of the Internet, media has been abuzz about web-connected living room. There have been several unsuccessful attempts to bring the web to TV, but the user experience hasn’t matched the lean-back, simple remote controlled TV watching. The new-generation mobile devices such as iPhones and iPads could bridge the gap between the web and the TV, and make TV watching a truly social experience. A number of startups including Peel, Umee, and Miso are attempting to turn this vision into reality and the implications are huge since the winner would essentially influence the content promotion and consumption. I believe that TV will finally go social in the coming year and we will witness a breakout company in this space.

5. Online-Offline Commerce Accelerates

The astronomical growth of Groupon and LivingSocial* in the past two years heralded the integration of local businesses into the efficient marketing machine of the Internet. This online-offline commerce trend will accelerate in the coming year as more startup companies figure ways to leverage location capabilities of the smart phones to drive foot traffic to the local businesses. This acceleration would largely be driven by discovery via location based social experience sharing. The explosive growth of Instagram is an early sign of the experience sharing trend and we will witness a whole lot more in the coming year.

The New Year will create tons of opportunities. Are you ready?

*A Lightspeed Portfolio company

Posted by jeremyliew in 2011, advertising, Consumer internet, Ecommerce, ltv, mobile, predictions, social games.

Once again Lightspeed is going on the record with some prognostications for what the future holds. Before I try gazing into my crystal ball to see what 2011 will bring for the consumer internet industry, let me first see how I did on last years predictions:

1. Social games overflow out of Facebook

Grade: C+. While the amount of social gaming on other social networks, especially the Asian networks, has significantly increased over the course of the year, the vast majority of social gaming still takes place on Facebook. While Farmville.com now has 6M UU/month, this is still only 10% of the number playing Farmville on Facebook.

2. Brand advertising starts to move online, boosting premium display, video and social media

Grade: A. The recovering economy has really boosted brand ad budgets in 2010, with online ad spend back to setting records again. Automotive and CPG in particular are both seeing significantly increased online budgets. The online video networks are doing terrific business, and even Yahoo is benefiting from increased brand spend, seeing revenue growth for the first time in a while. Many brand advertisers are spending their experimental budgets widely in social media as they attempt to figure out how to promote themselves through Facebook, Twitter, Foursquare and other platforms. The key driver of this renewed confidence from brand advertisers is better measurement of brand metrics that can show the impact of online advertising beyond clickthrough.

3. Direct Response Advertising becomes ever more efficient

Grade: A. According to Adsafe, approximately half of display advertising inventory is now moving through exchanges, Demand Side Platforms (DSPs) and realtime bidding platforms, with another 23% moving through Facebook’s self service ads. These platforms are rapidly commodifying a lot of “low quality” ad inventory, enabling the use of data and targeting to find the best use of this inventory, and thereby creating a very efficient marketplace. Direct response advertisers have benefited the most from this transparency.

4. Finding money and saving money online

Grade: B-. Saving money online has been a real driver of ecommerce growth in 2010. The breakout categories of 2010 are Local Deals (Groupon, Living Social* etc), and Flash Sales (Gilt, RueLaLa, HauteLook, Ideeli etc), and both are squarely aimed at helping consumers save money. Finding money online (principally online lending) has not seen the same level of explosive growth in the US, although in Europe and India there has been real growth in microlending (including “pay day loans”) from companies ranging from Wonga to SKS Finance. I think we’ll see more from the online lending space in 2011, so I may just have been too early on that part of the prediction!

5. Real time web usage outpaces business models

Grade: B-. Twitter continues to grow in usage, overtaking Myspace to become the third largest social network in the world. Foursquare and Gowalla have grown too, but off of much lower bases, such that only 4% of internet users currently use a check-in service. Facebook also joined the Location Based Services (LBS) party this year, enabling Facebook places, which some speculate is getting 30M users already. Last year I speculated that monetization would be hard for these businesses since CPM models have traditionally been hostile to user generated content, and local ad sales is an expensive and difficult proposition. But these companies have innovated new monetization models. Twitter, through its Promoted Tweets, Promoted Trends and Promoted Accounts, is not selling media on a CPM basis, but rather selling attention, and the early returns suggest that brands are willing to pay for more attention. Similarly, the check-in services are attracting experimental budgets from national retailers as well as forward thinking small businesses who are eager to attract new customers into their stores, and reward regular customers. While the revenue numbers may not be huge in 2010, there is certainly promise to the business models that are developing on these platforms.

Overall for 2010, I figure a B average, a little worse than last year. But there is always grade inflation when you grade yourself, so let me know what you think. Now, on to my predictions for 2011:

___________________________________

1. Putting fun into ecommerce

In 1995, when Amazon was founded, e-commerce was like the proverbial talking dog. It wasn’t about how well the dog could talk, it was amazing that the dog could talk at all. The first generation of ecommerce sites were focused on functionality, getting the dog to talk better. We got everything from price comparison engines to aggregated user reviews to one-click checkout. These early innovations were focused on optimizing the “workflow” of shopping to get users into the checkout as quickly as possible.

This worked great for most internet users at that time because back then most internet users were men, and in general, men do not like to shop. They treat it like a chore, a necessary evil that would ideally be minimized and optimized to take the least amount of time possible. Then they could get back to doing something they enjoyed, perhaps playing video games, or watching football!

But a few years ago, that changed. There are now (a few) more women online than men. And in general, women tend to enjoy shopping more than men. Certainly more than playing video games, or watching football! If you enjoy shopping, you don’t want your “workflow optimized”. You don’t want to be rushed to the checkout as quickly as possible. Instead, you want to linger, to be delighted, to discover new things, to find great deals. You want shopping to be fun.

The Flash Sales sites and Local Deals sites both make shopping fun by offering deep discounts. This is the mechanism that they use to entice shoppers to buy something, even when they are not looking for anything specific. But discounts are not the only way to make shopping fun.

Sites like Modcloth make shopping fun through discovery. Modcloth highlights women’s clothes from modern, indie and retro designers. Because each item has limited supply, and selections are constantly changing, Modcloth builds an urgency that has users coming back frequently to see what’s new and to make sure that they don’t miss out.

Shoedazzle* makes shopping fun by democratizing the personal stylist experience. After users take a style quiz to assess their profile, they are shown a selection of shoes, bags and accessories that have been specifically chosen to match their taste. Each month they get a new selection of on-trend pieces that fit their profile. JustFab and JewelMint have subsequently launched with similar models.

More models keep popping up. Recently launched Birchbox focuses on sending cosmetic samples to its users to help them discover the perfect eyeliner or blush. Pennydrop is a Facebook app that lets users peek at discounted and constantly dropping prices on items and jump in to buy when the price is low enough.

All these sites play to the idea of making shopping fun. I expect to see more applications of these formats, as well as more new formats, all under this overarching theme. A little social shopping anyone?

2. Self-service ad platforms find their ceiling, and brand advertisers seek other avenues

As noted above, about half of display advertising inventory is now moving through exchanges, DSPs and realtime bidding platforms. Yet these platforms are only two to three years old. While perhaps only 10% of online ad revenue is currently flowing through these channels, the trend here is clear. Today, two thirds of online ad spending comes from direct response advertisers, and soon the bulk of these budgets will likely flow through bidded platforms such as these, including Facebook ads. Direct response advertisers move their budgets quickly to follow results, so this could happen within the next year or two.

Brand advertisers are also experimenting with bidded platforms. Each of the big ad agencies have their own trading desks. However, adoption on the brand side will likely be slower and far from complete. Many of the exchanges, DSPs and RTB platforms allow for bidding strategies that are easily optimized for click-through rates, but optimizing for brand metrics is much harder. Brands also care more about content adjacency and brand safe content, and these are harder to guarantee on an exchange type platform, where in some cases, ad impressions are traded several times before finding their final buyer.

In addition, exchanges by definition can only support standard ad units. Many brand campaigns incorporate custom elements, ranging from social media and other earned media components to custom microsites, site takeovers, roadblocks and other high impact units. These are often tied to specific publishers, and bundled into a broader media buy including standard ad units. Premium publishers depend on this sort of creative advertising to maintain the ad rates required to support the creation of high-quality content, and I think it is likely that this symbiosis between brands and premium publishers will continue to capture a large chunk of the brand ad budget. In fact, I expect to see a proliferation in custom ad units from the biggest and most premium publishers as they work to capture a greater share of brand budgets. Non-premium publishers that have reached the scale to become “must buys” are doing exactly the same thing. Twitter’s Promoted Tweets, Promoted Trends and Promoted Accounts, and Facebook’s Social Ads and Likes are all great examples of this trend.

3. Competition shifts from user acquisition to user retention

Today many e-commerce and subscription companies are growing very quickly through smart marketing. They are taking advantage of cheap media to cost effectively acquire new customers. As I’ve mentioned above, I think the exchanges will continue to make it easier for direct marketers to reach their customers. Facebook’s self service platform is still a relatively inefficient market, allowing savvy, analytical marketers to quickly and cheaply gain market share. However, in some categories (e.g. Local Deals) Facebook has quickly become efficient and there is already a “market price” for a new Local Deals subscriber. As more marketers take the plunge into Facebook’s platform, more categories will become efficient, just as Google became an efficient market over time for almost all keywords. Once this happens there will be a market clearing price for new customer acquisition across almost all categories, and smart marketing will no longer be as much of a differentiator.

On what basis then will winners pull away from the rest? Companies who are able to derive the highest lifetime value (LTV) from their users will squeeze out their competitors with a lower lifetime value. How can you improve LTV? There are three key factors:

- average revenue per user

- gross margin

- average lifetime.

The e-commerce and subscription based companies that pull away from their competitors in 2011 will find a way to differentiate themselves from their competitors on one or more of these dimensions.

4. Social games chase hardcore gamers

Notwithstanding Disney buying Playdom* this year and EA buying Playfish last year, Zynga is still the market leader in social gaming. Their enormous installed user base gives them a real advantage in customer acquisition cost over their competitors; their ability to cross-sell installs to their new games at zero cost allows them to get a new game to scale with much lower marketing spend then smaller competitors.

To combat Zynga’s might, the other social game publishers have to focus on games with a very high LTV. High enough that the publisher can afford to rely on paid customer acquisition alone to build a user base, and still make money. Kabam (once know as Watercooler) pioneered this approach with Kingdoms of Camelot, a relatively hardcore social game that is reputed to be doing low to mid single digit millions in monthly revenue from about 750k Daily Acitve Users (DAUs) – a monetization rate that is dramatically higher than the norm for social games. Other publishers have taken note, and I would expect more games aimed at the hardcore gamer market to emerge over 2011.

5. Year of the tablet

Smartphones transformed the mobile internet. Apps will drive $5bn in revenue in 2010. Mary Meeker presents some great insight into the future growth potential of mobile in her Web 2.0 Summit presentation, Ten Questions Internet Execs Should Ask and Answer.

The same thing will happen with tablets. While the iPad has the tablet market largely to itself this year, that will change dramatically in 2011 and beyond, just as Apple’s iPhone had the truly web-capable smartphone market to itself in 2008, but is now a minority as competition emerged from Android, WinMo7 and the modern Blackberry.

The key difference between these new platforms and the PC web isn’t mobility (although that is part of it), but rather that these devices are always on and always with you. However, use cases differ between the phone and the tablet.

Phones are with you all the time, in particular when you are out of the house and out of the office. The most popular genres of app fit well with this “on the go” usecase. Local information, “snacky” entertainment, music, games have all been killer apps on smartphones. Some web incumbents made the transition well, including Yelp, Flixster*and Pandora. Many new companies also gained ground on the phone through this disruption.

Tablets tend to live in the living room. They lend themselves more to leisure than PCs, and to more protracted content consumption than phones. Killer apps might include, video, music, games, and “reading”, broadly defined. Again, some web incumbents will make the transition well, but once again I expect to see new companies gain ground through this disruption.

What do you think will happen in 2011? This time next year ,I’ll look back to see how accurate I was. In the interim, stay tuned for more Lightspeed predictions in other tech sectors over the next few days.

_________________________

* A Lightspeed Portfolio company

Posted by jeremyliew in advertising, branding.

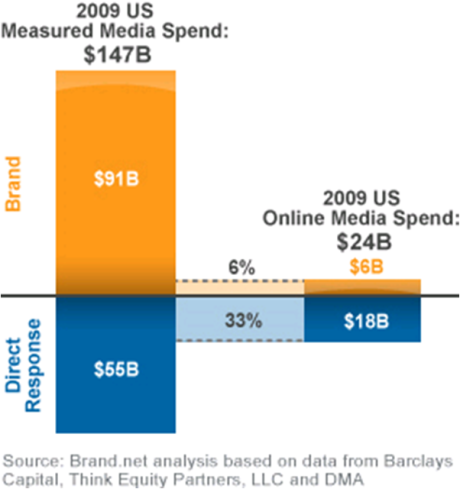

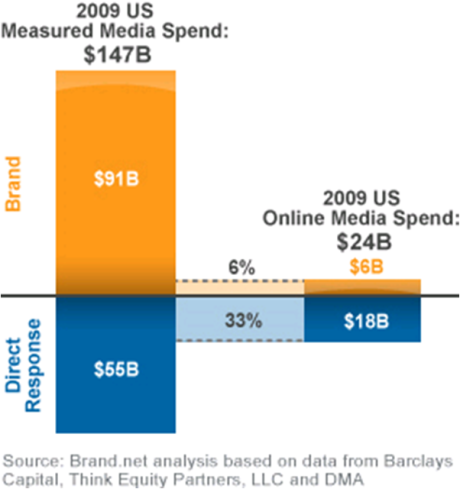

One of Lightspeed’s consumer internet predictions for 2010 is that brand advertising dollars are going to start to flow online at scale. Two thirds of all ad spending in the US is for brand advertising, yet three quarters of online ad spending is direct response.

The recession of the last couple of years has provided a catalyst to drive more brand marketers online in an effort to seek greater efficiency in their media buys, and as they have tasted some success, they will continue to spend online as their marketing budgets recover.

Late last year the IAB put out a very interesting study about building brands online. I recommend that you read the whole thing if you are involved in the online advertising industry.

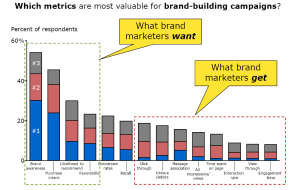

For those of you who won’t, here are some highlight charts:

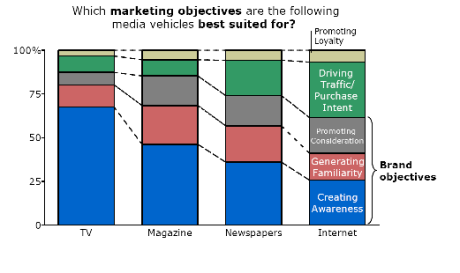

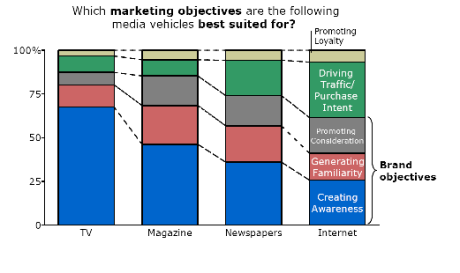

Marketers believe that the internet can be a branding mechanism:

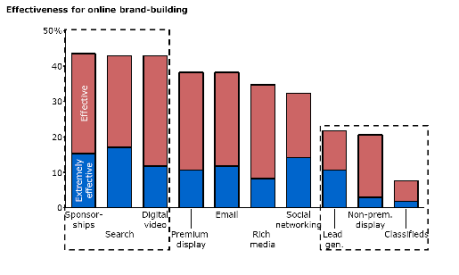

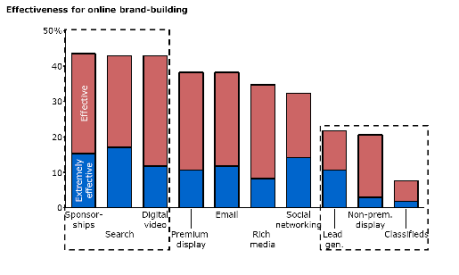

But the bulk of online advertising volume today is not considered effective for brand building:

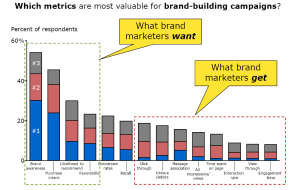

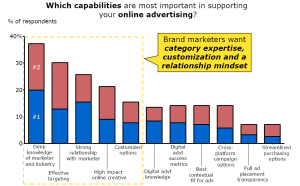

This is because most online ad inventory has been optimized for direct response advertisers, whereas brand marketers want to see their traditional metrics (click image to see full detail):

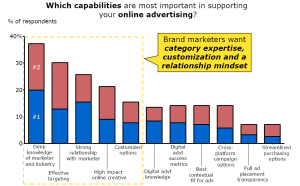

Furthermore, brand advertisers want relationships with the media companies that they work with, not simply self service efficiency (again, click image to see full detail)

Most brand advertisers have primarily stuck with portals and big publishers who offer brand safety, reach/frequency control, reporting on the metrics that they care about and strong relationship, but often tied to higher priced media. As brand advertisers seek better efficiency from their online media budgets, they will turn increasingly to ad networks. Although there are over 300 ad networks today, the vast majority of them have grown over the last 10-15 years by optimizing their offering for the direct response advertisers who have constituted the vast majority of online advertisers to date. I think we’ll see a new generation of ad networks emerge who are tuned to cater to the specific needs of brand advertisers, and I’m actively looking to invest in companies with this mindset.

Posted by jeremyliew in ad networks, advertising.

I’ve noted in the past that the four core competences of ad networks are:

Aggregating Inventory

Aggregating Data

Targeting

Sales

Better targeting has historically been one core area of competition for ad networks, especially those focused on direct response advertising. However, as Anand Rajaraman (co-founder of Kosmix, a Lightspeed portfolio company) points out, more data usually beats better algorithms. Andrew Chen recently noted that after three years of work, Netflix awarded its $1m prize to a combined team of experts for an algorithm that only improved targeting by 10.5%:

This means if you combine dozens of the best machine learning people in the world, some of the cleanest datasets, you get a measly 10.5% increase. Compare this to starting a new ad network where you end up with noisy datasets, lots of crappy traffic, and a small team looking at the problem – that’s not an easy path to disruptive change. In general, 10% is not a big enough number to counteract the other economic drivers in the ad market, which revolves around better deal terms, a larger selection of advertisers, better ad inventory, etc.

Note that this observation comes from a guy who was a co-founder of Revenue Science’s Ad Network business!

While I agree with Andrew in principle, I think that even a 10% edge in targeting can be enough to build a competitive advantage in the direct response world. Because competition for publishers is fierce, and publishers switch ad networks frequently in search of higher RPMs, a slight edge in targeting can lead to a slight edge in publisher payouts which can lead to an overwhelming win in volume.

Andrew thinks that breakout ad network performance will come from two of the other key competency areas:

I think disruptive change will come not from algorithms, but rather two other areas:

* Better ad inventory: New websites and mechanics emerge all the time, and who knows what happens when you put ads on them? It was clear, until they tried it, that with the right ads search can be >30% clickthrough rates or more, which is unheard of.

* Better data: The other big opportunity is in using specialized data to drive your algorithms – rather than basing everything off of domains, cookies, and ad impressions like everyone else, there may be ways to extend the targeting to unique datasets that no one has access to. This is what’s happening in the world of retargeting.

These are good thoughts, and well worth exploring. Better ad inventory can be difficult to defend in an age of exchanges like Right Media and the Doubleclick ad exchange. However, in some areas such as mobile, video, in-game advertising and client driven inventory, it is still possible.

Data is also improving. But because it is also becoming more of a commodity, the real question will be whether this data can be proprietary. If the proposed FTC rules on third party cookies for behavioral targeting take effect, it could give some of the big web properties access to their own proprietary targeting data that will give them advantages over third party networks. Taking offline data and using that for online targeting is also another possibility.

In the brand advertising world, I think that sales will be a real differentiator. The big brand budgets are just starting to move online. CPG, one of the core categories for brand advertising, is starting to shift online this year in a meaningful way. But brand advertisers need to be sold to the way that they want to buy. Not all online sales teams know how to do that. Facebook’s recent partnership with Nielsen to show brand lift means that now only four online media companies have the ability to show the impact of a campaigns effectiveness on brand metrics (Yahoo, AOL, Facebook and Brand.net). I expect more companies to start reporting these sorts of brand lift metrics as a matter of course if they want to take their share of brand advertising dollars as they move online.

Which new startups do you think have a breakthrough in any one of these areas of core competence?

Posted by jeremyliew in ad networks, advertising, behavioral targeting, legislation.

Last month I raised some concerns that the government could make monetization even harder for online ad networks and publishers through limiting their ability to do behavioral targeting. The pressure to do so is rising as the NY Times reports:

On Tuesday, 10 major privacy groups plan to demand new privacy legislation from Congress regarding online behavioral tracking and ad targeting.

The roster of groups is a who’s who in consumer and privacy circles: Consumers Union, Electronic Frontier Foundation, Consumer Federation of America, Center for Digital Democracy, U.S. Public Interest Research Group, and others.

Among the things they’re asking for: No sensitive information (like health or financial information) should be used for behavioral tracking, no one under 18 should be behaviorally tracked, Web sites and ad networks shouldn’t be able to keep behavioral data for more than a day without getting an OK from the individual they’re tracking, and behavioral data can’t be used for discriminatory purposes.

While it is always hard to argue against privacy, the impact of this level of restriction would be enormous for companies relying on online advertising. Financial services and pharma/health are two of the leading categories for online advertising; the youth demographic is highly attractive to many advertisers, and limiting behavioral targeting to one day without an opt in severely restricts the usefulness of the data.

I’ve spoken to a number of people at venture backed ad networks, and it is clear to me that more needs to be done to organize feedback to the FTC and congress about the proposed rule changes and legislation.

Posted by jeremyliew in advertising, business models, flash, game design, games.

Dan Cook has a great post about business models for flash game developers over at Lost Garden. He says:

Ads are a really crappy revenue source

For a recent game my friend Andre released, 2 million unique users yields around $650 from MochiAds. This yields an Average Revenue Per User (ARPU) of only $0.000325 per user. Even when you back in the money that sponsors will pay, I still only get an ARPU of $0.0028 per user. In comparison, a MMO like Puzzle Pirates makes about $0.21 per user that reaches the landing page (and $4.20 per user that registers)

What this tells me is that other business models involving selling games on the Internet are several orders of magnitude more effective at making money from an equivalent number of customers. When your means of making money is 1/100th as efficient as money making techniques used by other developers, maybe you’ve found one big reason why developers starve when they make Flash games.

His solution?

Ask for the money

When game developers ask for money, they are usually pleasantly surprised. Their customers give them money; in some cases, substantial amounts. I witnessed this early in my career making shareware games at Epic in the 90s and I’m seeing the same basic principles are in play with high end Flash games. Fantastic Contraption, for example, pulled in low 6 figures after only a few months on the market. That’s about 100x better than a typical flash game and in-line with many shareware or downloadable titles.

I think his conclusion is right not just for Flash game developers, but for all sorts of game developers, including MMOGs, iPhone games etc. dan runs through some steps that game developers should take to maximize their chances of being able to make a living from designing games, specific ideas about what to charge for, and responses to common objections to getting users to pay. For new or aspiring game designers, it is worth reading the whole thing.

Posted by jeremyliew in advertising, business models, media, startup, startups.

AdAge has a good article today about how AOL has been attacking web publishing where it notes:

In the heady days of early 2000, the megamerger of AOL and Time Warner heralded the web-based future of publishing. It would create a digital platform for Time Inc., the biggest, most-prestigious magazine group in the world.

Needless to say, that didn’t pan out, and here’s where it gets ironic. Just as Time Warner is unwinding that mistake, AOL is figuring out the future of magazine publishing on the web. And it’s doing so without Time Warner’s content assets.

The model goes something like this: Find a vertical with an audience attractive to advertisers, brand it (Daily Finance, Asylum, Lemondrop, Politics Daily), hire five to seven people to run it and plug in AOL’s traffic fire hose. Repeat.

This reminded me a little bit of the continual tension in media companies caused by serving two constituents – readers and advertisers. AOL has clearly discovered one path to repeatable success, which is to start with the needs of advertisers. This is emphasizing the “media” part of new media.

The new media companies that are doing the best in this recession have taken a similar approach. Companies like CafeMom, Flixster (a Lightspeed portfolio company) and Glam have focused on creating highly valuable inventory for endemic advertisers, and on building excellence in sales execution.

In contrast, some other startups have focused on the “new” part of new media. They have often created incredible compelling experiences for users, and have generated impressive traffic. But their monetization ability has lagged; sometimes due to creating inventory that is hard to sell, sometimes because the startu’ps culture is not inimical to ad sales.

Here in Silicon Value there can be a tendency to overemphasize product and technology and underemphasize ad sales. Advertising revenue often scales with ad sales people. Yet I have seen some startups that have been disappointed with their revenue growth but have >10% of their employees focused on revenue.

Like AOL, new media companies should remember that they are also media companies, and organize themselves appropriately. This can include doing things like:

– Building traffic with a consideration for your ability to package and sell it to advertisers

– Placing significant company and senior management attention on revenue. This can mean up to 30-50% of employees working on revenue generating activities

– Adding advertising sales expertise and contacts to the management team

– Being flexible about tradeoffs between advertiser needs and user needs

Many new media companies based outside of Silicon Valley (especially those in New York) grasp this innately.

_______________________________________________________________

For more in this vein read two prior posts; on the preeminent importance for sales excellence in ad networks, and on the three ways to build an online media business to $50m in revenue.

Posted by jeremyliew in advertising, video.

eMarketer has a couple of interesting charts on CPMs by media types.

First offline media:

Next online video:

Online video preroll CPMs are at $25-35.

TV CPMs are at $6-10.

Even granting some premium for preroll that has to be watched (vs TV which can get skipped), these CPMs can’t hold up.